BY FAZAAD BACCHUS

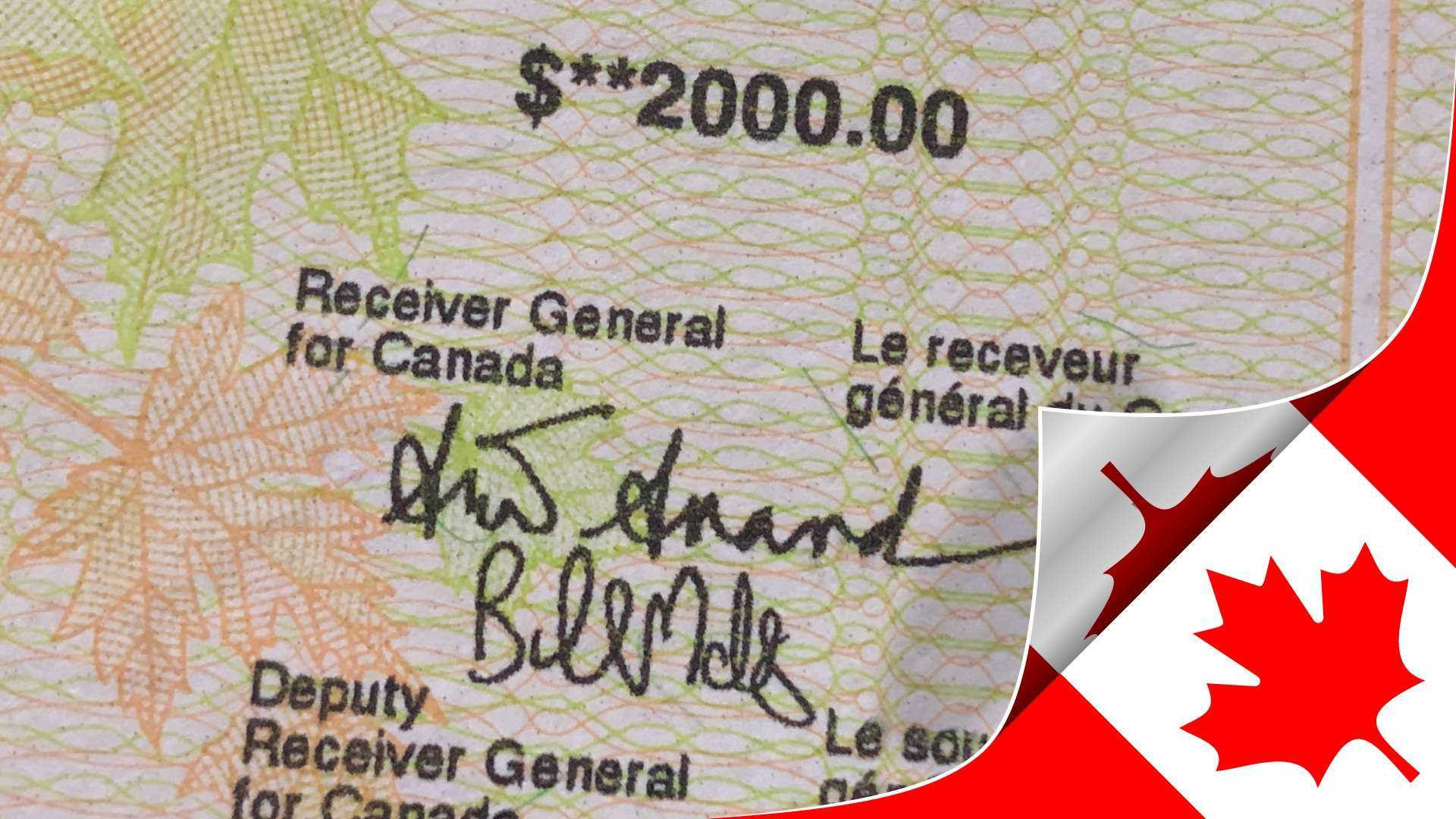

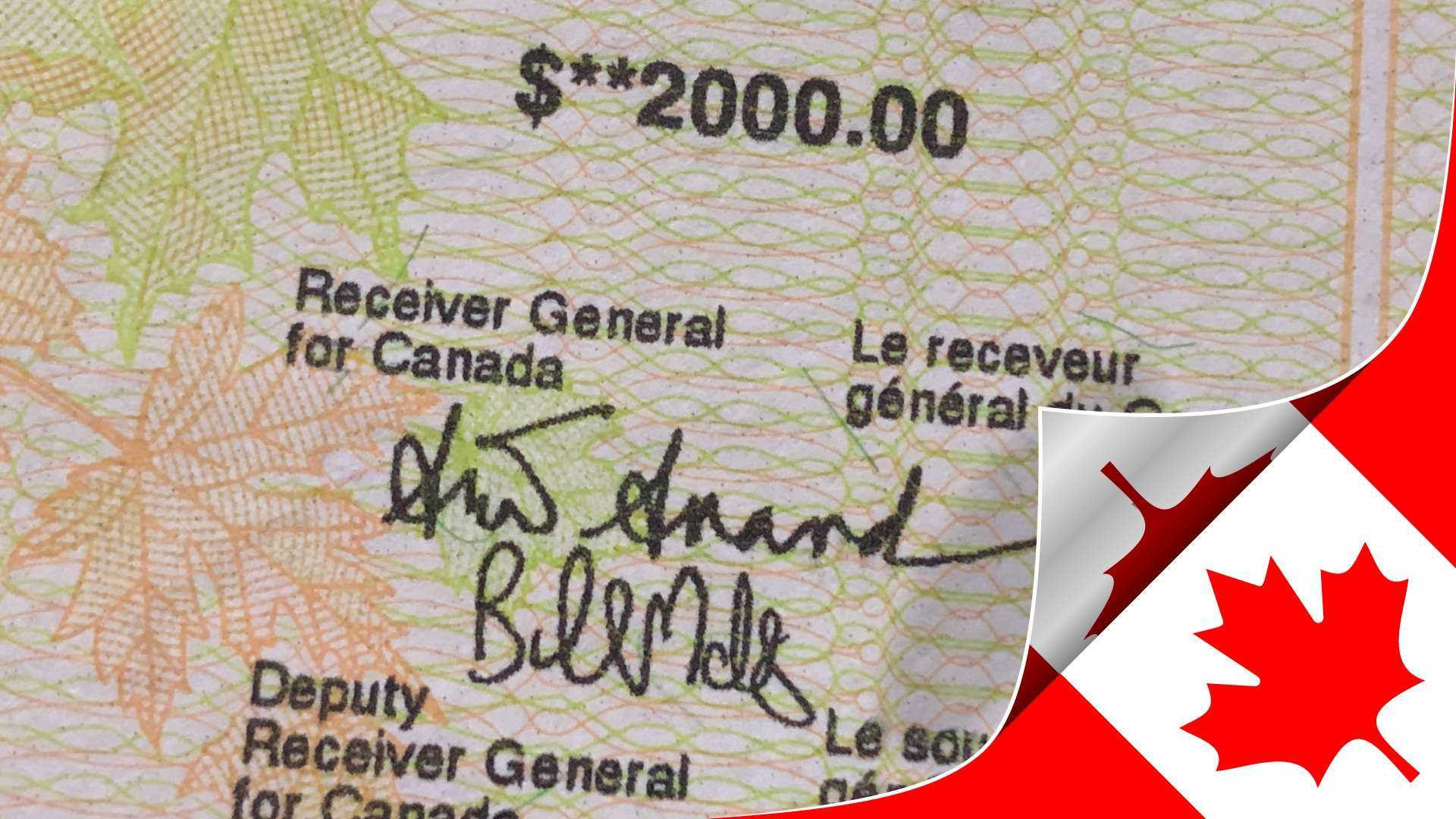

The COVID-19 situation has taken a toll on the financial situation of many Canadians. Over the last few issues, I have written about the relief measures being put in place by the government namely referred to as the CERB. These include the monthly subsidy of approximately $2,000, increased child benefits and increased benefits for seniors. We also discussed how these benefits were taxable and how you needed to allocate some money when tax time comes around next year.

In this issue we will discuss how private firms like insurance companies and internet service providers are also stepping up to assist. We have already discussed that banks are willing on a case by case basis to defer mortgage payments. You are required to call your bank and speak to an officer as this deferral is not automatic and neither is it guaranteed. Be careful when you sign the agreement as it may require you to double up on interest payments.

Let’s go to insurance companies. Due to COVID-19 certain insurance companies have made adjustments to the receipt of premium payments. If for example you own a life insurance policy and are unable to pay the premiums, certain companies will waive the premiums for a duration of three months. Should a person pass away during this period then the premiums will be deducted from the death benefits thereby reducing the death benefit by that amount.

If you have a permanent policy with cash values, the company will take from your cash value to pay the premiums and apply it as policy loan. This loan will attract an interest and it is a repayable amount or else it will be taken from the death benefit. If you cannot pay your premiums during this period, you may take advantage of this automatic premium loan.

Auto insurance companies have also stepped up. They know that many people are now working from home and are hardly using their cars. Some companies are allowing a reduction in premiums based on your usage. You would be required to check with your company to see the proposal that they have put forward. There is always the regular freezing of your coverage and hence freezing your premium payments, so if you have two cars, then you might be better off storing one in the garage and stopping the payment on it.

Internet and mobile providers have also assisted during this period. There are some companies (not naming any) that have reduced the overall rates on long distance calling, while some have waived extra usage fees. Some have waived extra usage for home internet (for those who have limited internet) should you exceed your limit. Certain companies are also providing free television programming during this period also, as they are aware that so many people are at home.

These are difficult and unprecedented times. We haven’t had a situation like this in Canada before. It is a time to rethink your spending habits and learn to enjoy and appreciate whatever little we have.